Some definitions in the investing world can be very complex. And sometimes they really are when you dig deeper into the topic. In this article we will try explain what is a Return On Investment (ROI) in a simplest possible way.

In simplest terms it is a measure of how well your investment performs. It is a basic and commonly used measure. You can use it to compare different investments between each other.

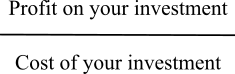

You calculate ROI by diving your profits by total costs of your investment.

I.e. if you purchased an asset (i.e. a house) for £100,000 and sold it for £120,000 you made a profit of £20,000. £20,000/£100,000 gives you a return of 0.2 which we translate to 20%

Limitations of simple Return On Investment (ROI) definition

This is a very simple measure and as you probably already notice, there are a few factors that are not taken into account. Some of them can impact those numbers: additional costs, taxes, inflation, time and finally, increase/decrease of asset value and what is often forgotten — opportunity cost.

The best you can do is try to include some of those factors into the calculation. I.e. you can deduct additional costs or taxes from your profits. You can also calculate in time into this equation by taking annual profit — if your investment is a long term investment:

where annual profit will be a net profit (including costs and taxes).

It gets more complex when you try to calculate in increase and decrease of asset value. We will take a look at it tomorrow when we look at ROI in rental properties.

Return on Investment sounds easy but if you look into details it can get pretty complex. Nevertheless this measure decides how well our money works for us. That is why It’s important to understand this complexity and use this measure with caution. Especially if you compare assets of different type.